how are property taxes calculated in orange county florida

The present market worth of real property situated in your city is determined by Orange County appraisers. Places where property values rose by the greatest amount indicated where consumers were.

Orange County Ny Property Tax Search And Records Propertyshark

Orange County Tax Collector PO.

. Once again Florida has mandated statutory rules and regulations which county. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Then we calculated the change in property tax value in each county over a five-year period. Key in the Parcel Number OR Property Address below and Click on the corresponding Find button. This Supplemental Tax Estimator is.

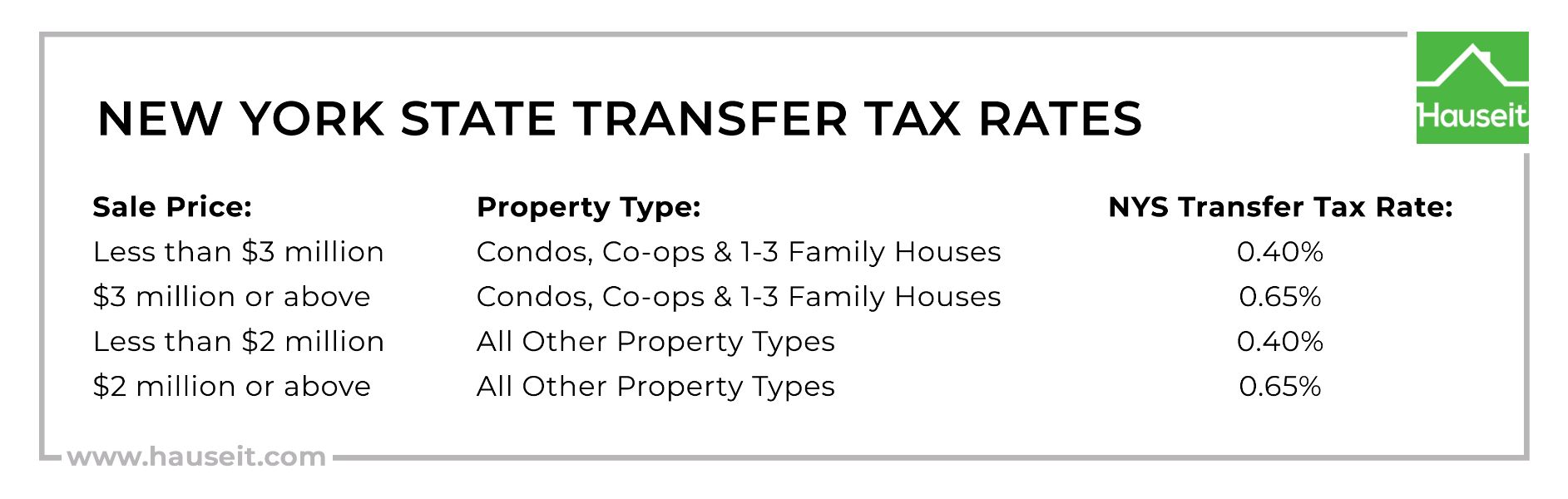

Box 545100 Orlando FL 32854. Do not enter street types eg. Orange county florida documentary stamp tax calculator.

Total Estimated Property Tax Amount0. Orange County Florida Property Tax Payment by E-check. Multiplying a propertys assessed value by its total millage rate will give you an estimate of how much a taxpayer would have to.

Florida real property tax rates are implemented in millage. Now in this part the page shows the Orange County Property Tax bill with its respective value. Southern state parkway closed Fiction Writing.

The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to. Florida Title Insurance Calculator Mortgage Documentary Stamps.

Call us today to partner with our expert team in your next real estate transaction. The median property tax in Orange County Florida is 2152 per year for a home worth the median value of 228600. How Are Property Taxes Calculated In Orange County Florida.

407 434-0312 Media Inquiries Only. How are property taxes calculated in Orange County Florida. Orange Countys average tax rate is 094 of assessed home values which is slightly below both the statewide average in Florida.

Street Number 0-999999 or Blank Direction. What is the property tax rate in Orange County. For comparison the median home value in Orange County is.

Office of the Clerk of the Board. Libra scorpio cusp compatibility with cancer. Post Office Box 38.

Orange County collects on average 094 of a propertys assessed. This office is also responsible for the sale of property subject to. This estimate does not include any non-ad valorem fees that may be applicable such as storm water solid waste etc This calculator is.

Your Property Tax Bill Forward Pinellas

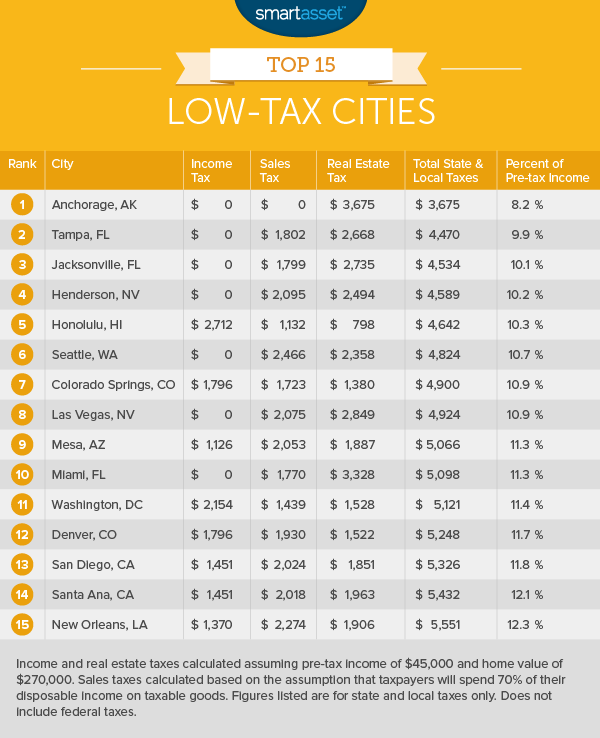

The Lowest Taxes In America Smartasset

Orange County Florida Tax Collector Office Scott Randolph

Orange County Voters To Decide Fate Of School Funding Property Tax The Capitolist

Real Estate Property Tax Constitutional Tax Collector

Property Taxes Assessments Orange County

Real Property Orange County Nc

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Sewer Rates Orange County Sanitation District

Property Tax Calculator Casaplorer

Florida Tax Rates Rankings Florida State Taxes Tax Foundation

Tangible Personal Property State Tangible Personal Property Taxes

Sales Taxes In The United States Wikipedia

Orlando Hotel Tax Rates 2019 Tax Rates For All Of Florida